Investment Proposal:

Building a Leader in the New Tourist Sharing Market

Our electric motorcycle sharing model is poised to replicate the rapid growth of the sharing market that began in 2017, which grew from $0 to $50 billion in 8 years⁷, while avoiding the fundamental problems faced by first-wave companies.

By carefully studying the successes and failures of the first wave, we have taken what drove their rapid growth and re-engineered what created problems.

First-wave companies like Bird and Lime built their models on electric scooters and bicycles.

They appeared on the urban scene in 2017 and quickly became venture capital favorites, attracting over $2.5 billion in investment and reaching multi-billion dollar valuations in record time. The projected global market value is expected to reach $40-50 billion by 2025⁷.

This demonstrates the market's huge appetite for new micromobility models.

Section 1: Executive Summary

- Vision: VAU Ride is creating a leader in the new, high-margin "Tourist Sharing" market, solving transportation problems in Europe's largest tourist regions.

- Problem: We are solving the transportation collapse for 25 million tourists at Lake Garda, where the micromobility market (SAM) is estimated at €81 million.¹

- Traction: Our MVP with 17 scooters proved profitability with a margin of 87%⁴ and an LTV/CPA ratio > 30, confirming operational break-even.²

- Team: We are a team of founders with a unique combination of local expertise at Lake Garda and international experience in creating and scaling technology projects.

- The Ask: We are raising €1,600,000 to scale our fleet to 300 scooters and capture a dominant market share at Lake Garda.⁵

More details in the section: Business Plan

Section 2: The Problem

Lake Garda is Choking on "Overtourism"

An annual influx of 25 million visitors¹¹ creates a transportation collapse. Severe traffic jams and systemic mobility failures degrade the tourist experience and strain infrastructure. Local authorities and communities are urgently seeking sustainable solutions to reduce dependence on private cars.

Section 3: The Solution — VAU Ride

Creating a New Niche: Tourist Sharing

VAU Ride is a second, smarter wave sharing company. By carefully studying the successes and failures of the first wave, we have adopted what fueled their rapid growth and re-engineered what caused problems.

Our business model is perfectly adapted for tourist regions:

- Electric Scooters Instead of E-scooters: Operating within traffic laws, eliminating regulatory risks.

- Parking Network Instead of Chaos: Managed logistics and no residential complaints.

- High-Value Customer: The model targets affluent tourists, ensuring a high average check and careful handling of assets.

Section 4: Why Now? The Market and First-Wave Lessons

The e-scooter market grew from $0 to $50 billion in 8 years, proving the demand for micromobility. First-wave companies faced fundamental problems that we have solved:

- Low Unit Economics: VAU Ride's average transaction value is €22.57, which is ~6.5 times higher than in urban sharing (~€3.5).²

- High OPEX: Our on-site battery swapping model is 5-7 times cheaper than the urban sharing operational model.

- Regulatory Barriers: Unlike urban sharing, which faced bureaucratic hurdles, our model is designed for tourist regions from the outset. Placing parking stations on private properties (hotels, campsites) allows us to scale the network quickly, acting as a partner to local authorities, not a competitor.

Tourist regions are huge, untapped markets with high potential for global scaling.

Section 5: Our USP — The Tourist Sharing Model

| Conventional Urban Sharing | VAU Ride Tourist Sharing |

|---|---|

| Legal Framework: Constant regulatory barriers | Clear legal framework: Electric scooters are standard vehicles |

| OPEX: High costs for battery swapping | 5-7x lower OPEX: Scheduled battery swaps at parking stations |

| Customer: Low average check (~€3.5), high vandalism | Customer: High average check (€22.57)², solvent tourist |

Section 6: Project Stage and Traction

- Project Stage: Growth Stage

- Proven Business Model: The service is launched, operational, and in high demand. The MVP with 17 scooters has reached operational break-even.²

- Product-Market Fit Achieved: LTV €32.79, CPA €1.09. LTV/CPA ratio > 30.²

- Subsidies Secured: Received government support covering 30% of the MVP fleet cost.

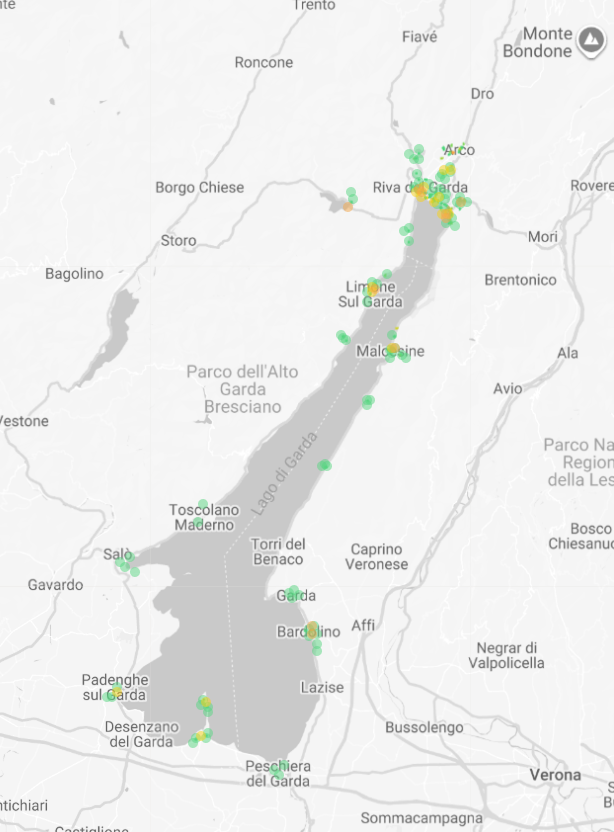

- Expansion Signals Received: A heat map shows massive searches for our scooters throughout the region, far beyond the current operational zone.

Heat map of VAU Ride motorcycle searches

Section 7: Business Model

Our business model directly competes with traditional rentals, outperforming them on key parameters of customer convenience and operational efficiency.

| Traditional Rental | VAU Ride Tourist Sharing |

|---|---|

| Requires an office and staff, only during business hours | 24/7 rental via app |

| Fixed rental periods (half-day/full-day) | Per-minute billing and flexible hour packages |

| Must return the scooter to the same location | Transportation network: Pick up in one town, drop off in another |

| Daily rental from €65 to €80 | Daily package price €60 |

Key advantages of our model:

- Flexible and Favorable Tariffs: Per-minute billing for short trips and hour packages for long tourist routes provide maximum flexibility and value for the customer.

- Network of Parking Stations: Creates a transport network across the region, enabling business scaling and reducing operational costs for logistics and maintenance.

- Electric Transport: Provides access to government subsidies, support from the public and administrations, and full compliance with regional development plans (PUMS).

Section 8: Market Sizing

- Total Addressable Market (TAM): €463 million per year. (Total spending by tourists and locals on transport and relevant excursions in the region).¹

- Serviceable Available Market (SAM): €81 million per year. (Micromobility market share).¹

- Serviceable Obtainable Market (SOM): €4.8 million per year. (Our realistic goal for Year 3).¹

Our goal: To become the sole operator of tourist sharing at Lake Garda and to capture a dominant share of the two-wheeled rental market.

Section 9: Growth Plan

| Scale | Stage | Financial Outcome |

|---|---|---|

| 17 Scooters | MVP (Current) | Operational Break-even |

| 35 Scooters | Transitional | Planned Operational Loss |

| 50-75 Scooters | Regional Network | New Break-even Point |

| 150+ Scooters | Growth | Profit |

| 300+ Scooters | Round's Goal | Profit with >30% Margin |

| 1000+ Scooters | Further Growth | Super-profit |

Section 10: The Team

Our team is a synergy of three key competencies, mitigating the main startup risks: strategic vision, technological execution, and deep market integration. All founders reside at Lake Garda, ensuring maximum involvement and a unique understanding of local specifics.

Vadim Korovchenko: Co-Founder & Chief Strategist

A serial entrepreneur with 20 years of experience. Has built and scaled companies with revenues up to €6M/year and teams of up to 120 people. Experienced in successful business exits and managing IT startups.

Role in project: Strategy, capital raising, business scaling.

Arsenii Aleksandrov: Co-Founder, CEO & CPO

An IT architect and entrepreneur. For 8 years, led the creation of a complex cloud-based IT product, achieving positive unit economics. Personally designed and implemented the current VAU Ride IT platform.

Role in project: Operations, product development, technological advancement.

Oleg Rotaru: Co-Founder & CBDO (Chief Business Development Officer)

An entrepreneur with 20 years of experience managing a successful and profitable transport business directly at Lake Garda. Possesses a unique network of contacts, including working relationships with 40-50 hotels in the region.

Role in project: Business development, B2B partnerships, local market integration.

Section 11: Financials & The Ask

We are raising a round of €1,600,000 to scale to 300 scooters and establish a dominant network at Lake Garda.

In exchange for the investment, we offer a 32% stake in the company, which corresponds to a pre-money valuation of €3.4 million and a post-money valuation of €5 million.

Our valuation is based on:

- Proven and profitable unit economics (asset payback < 1 season at scale).⁴

- First-mover advantage in a huge market (SAM €81 million).¹

- A clear plan to reach €2 million in revenue and €1.1 million in EBITDA by Year 3.⁶

Section 12: Exit Strategy

1. Acquisition by a Major Sharing Company (M&A)

Our business model opens up a new, high-margin segment for market giants (Lime, Tier, Bolt) that is inaccessible with their current operational model.

2. Organic Growth

After dominating Lake Garda, opportunities will arise to attract major venture capital for rapid expansion into other tourist regions worldwide.

Why an acquisition is a more favorable strategy than competition: Their urban model is inefficient in tourist regions, their vehicles are not suitable for long-distance travel, and they lack our local expertise. Acquiring VAU Ride is the fastest, cheapest, and most risk-free way for them to enter this market.

Join us

Sources

- 1. Appendix A: Market Analysis

https://investors.myvau.com/offer/en/pdf/A-Market-Analysis.pdf - 11. Appendix A1: TAM Mobility Market Research

https://investors.myvau.com/offer/en/pdf/A1-TAM-Mobility-Market-Research.pdf - 2. Appendix B: MVP Results Report

https://investors.myvau.com/offer/en/pdf/B-MVP-Results-Report.pdf - 3. Appendix C: Growth Plan Rationale

https://investors.myvau.com/offer/en/pdf/C-Growth-Plan-Rationale.pdf - 4. Appendix D: Unit Economics Calculation

https://investors.myvau.com/offer/en/pdf/D-Unit-Economics.pdf - 5. Appendix E: Expense Plan (CAPEX & OPEX)

https://investors.myvau.com/offer/en/pdf/E-Expense-Plan-(CAPEX-OPEX).pdf - 6. Appendix F: Financial Model and Company Valuation

https://investors.myvau.com/offer/en/pdf/F-Financial-Model-and-Company-Valuation.pdf - 7. Growth of the sharing and micromobility market

https://gadallon.substack.com/p/the-rise-and-reckoning-of-scooter